How Strategic Financial Leadership Supports Fundraising and Sustainable Growth

Introduction

Scaling a startup is an inherently complex process, marked by rapid decision-making, constrained resources, and heightened expectations from investors and stakeholders. While founders often focus on product development and market expansion, financial discipline and strategic oversight frequently determine whether growth is sustainable or short-lived.

Empirical research consistently shows that financial mismanagement is a leading cause of startup failure. A significant proportion of startups fail not due to lack of innovation, but because of inadequate cash flow planning, weak financial controls, and insufficient readiness for fundraising processes¹1. As startups progress beyond the early stages, the need for experienced financial leadership becomes increasingly critical.

In this context, fractional Chief Financial Officer (CFO) services have emerged as a practical and effective solution. Fractional CFOs provide senior-level financial expertise on a part-time or engagement basis, enabling startups to access strategic financial leadership without the cost and rigidity of a full-time executive appointment.

Understanding the Fractional CFO Model

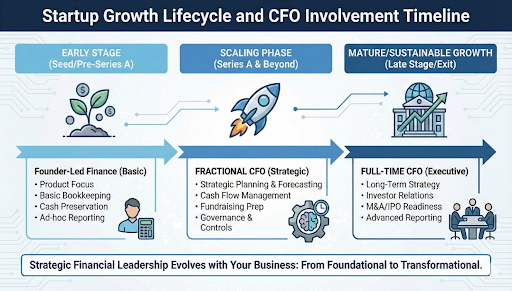

A fractional CFO is an experienced finance professional who performs the responsibilities of a traditional CFO on a flexible, non-permanent basis. Unlike a full-time CFO, a fractional CFO is engaged for a defined scope, duration, or number of days per month, depending on the organisation’s needs.

This model is particularly well-suited to startups and growth-stage companies that require high-level financial input but are not yet positioned to justify a full-time CFO role. Fractional CFOs typically bring prior experience from established corporations, professional services firms, or multiple startup environments, allowing them to apply proven financial frameworks across different business contexts².

From a governance perspective, fractional CFOs operate as independent advisors, providing objective financial insight while working closely with founders and senior management to strengthen financial decision-making.

Why Financial Leadership Is Critical During the Scaling Phase

As startups transition from early traction to scale, financial complexity increases significantly. Revenue models evolve, cost structures expand, and external stakeholders such as investors, lenders, and regulators demand higher levels of financial transparency.

Key challenges commonly faced during this phase include:

- Managing cash burn while pursuing growth

- Building credible financial forecasts and operating budgets

- Preparing for institutional fundraising and due diligence

- Establishing governance, controls, and financial reporting discipline

- Aligning financial strategy with long-term business objectives

Without experienced financial leadership, startups risk making growth decisions that are not supported by underlying financial capacity. Fractional CFOs address this gap by embedding financial discipline into strategic planning.

Core Benefits of Fractional CFO Services for Startups

- Cost-Effective Access to Senior Expertise

Recruiting a full-time CFO represents a significant financial commitment, often involving substantial fixed remuneration and long-term contractual obligations. Fractional CFO services allow startups to access equivalent expertise at a materially lower cost by paying only for the level of involvement required³.

This cost efficiency enables startups to deploy capital more strategically, particularly during periods where cash preservation is essential.

Recruiting a full-time CFO represents a significant financial commitment, often involving substantial fixed remuneration and long-term contractual obligations. Fractional CFO services allow startups to access equivalent expertise at a materially lower cost by paying only for the level of involvement required³.

This cost efficiency enables startups to deploy capital more strategically, particularly during periods where cash preservation is essential.

- Strategic Financial Planning and Forecasting

Fractional CFOs play a central role in translating business strategy into financial plans. This includes developing integrated financial models that link revenue drivers, operating costs, capital expenditure, and funding requirements.

Through scenario analysis and sensitivity modelling, founders gain visibility into the financial implications of strategic decisions, such as entering new markets, hiring senior talent, or adjusting pricing strategies.

- Cash Flow Management and Runway Preservation

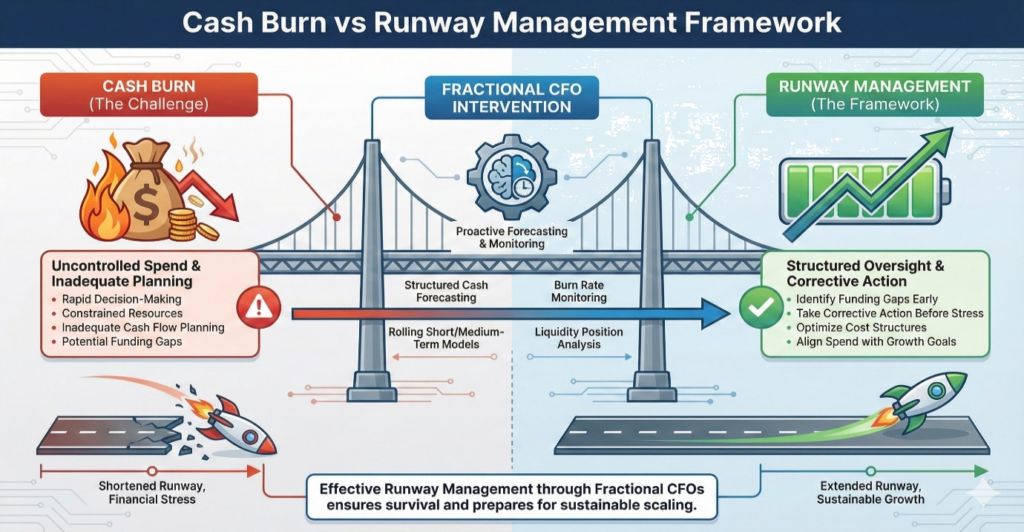

Effective cash flow management remains one of the most critical success factors for startups. Fractional CFOs introduce structured cash forecasting, typically through rolling short-term and medium-term cash flow models, enabling proactive decision-making.

By closely monitoring burn rates and liquidity positions, fractional CFOs help startups identify potential funding gaps early and take corrective action before financial stress emerges⁴.

- Fundraising Preparation and Investor Readiness

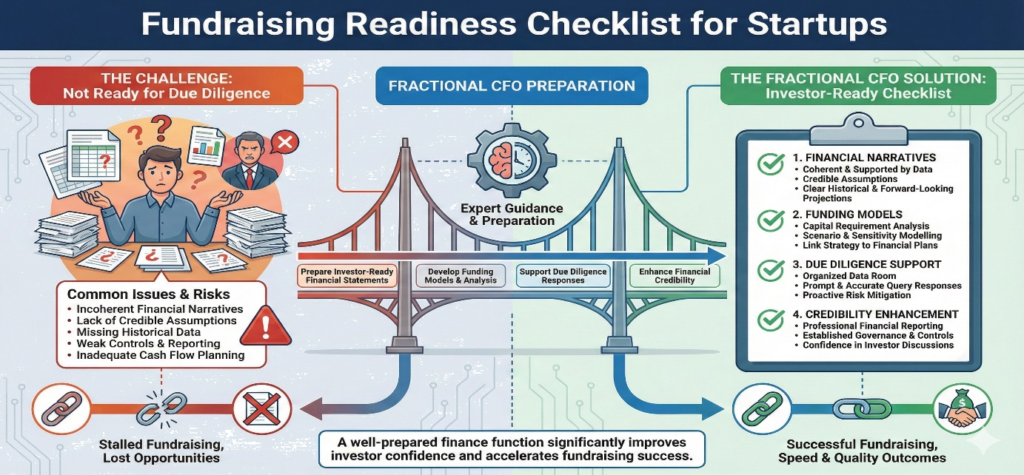

One of the most impactful contributions of a fractional CFO is in fundraising preparation. Investors expect startups to present coherent financial narratives supported by credible assumptions, historical data, and forward-looking projections.

Fractional CFOs support this process by:

- Preparing investor-ready financial statements and forecasts

- Developing funding models and capital requirement analyses

- Supporting management in responding to due diligence queries

- Enhancing financial credibility during investor discussions

A well-prepared finance function significantly improves investor confidence and can positively influence both the speed and quality of fundraising outcomes⁵.

- Governance, Controls, and Professionalisation

As startups grow, informal financial processes often become inadequate. Fractional CFOs assist in establishing appropriate governance structures, internal controls, and financial reporting frameworks proportionate to the organisation’s size and complexity.

This professionalisation not only supports internal decision-making but also aligns the organisation with expectations of external stakeholders, including institutional investors and regulatory bodies.

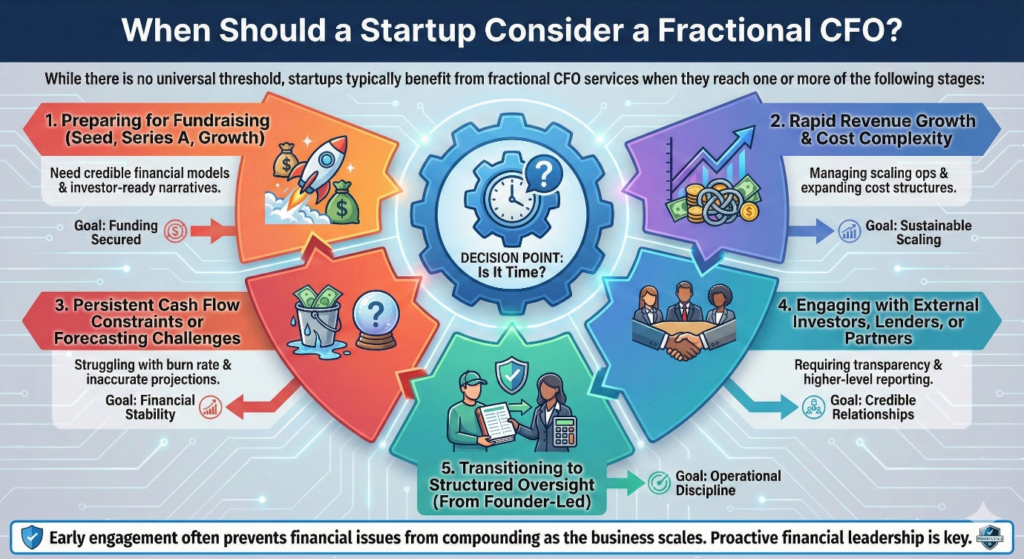

When Should a Startup Consider a Fractional CFO?

While there is no universal threshold, startups typically benefit from fractional CFO services when they reach one or more of the following stages:

- Preparing for seed, Series A, or growth-stage fundraising

- Experiencing rapid revenue growth with increasing cost complexity

- Facing persistent cash flow constraints or forecasting challenges

- Engaging with external investors, lenders, or strategic partners

- Transitioning from founder-led finance management to structured oversight

Early engagement often prevents financial issues from compounding as the business scales.

Conclusion

Fractional CFO services represent a pragmatic and increasingly adopted approach to financial leadership for scaling startups. By combining strategic insight, financial discipline, and operational flexibility, fractional CFOs enable startups to navigate growth with greater confidence and resilience.

Rather than viewing finance as a back-office function, successful startups integrate financial leadership into their strategic core. Access to experienced CFO-level expertise, even on a fractional basis, can materially enhance decision quality, investor readiness, and long-term sustainability.

Startups seeking to professionalise financial operations and strengthen their growth foundations may consider external CFO expertise as part of their broader strategic planning framework.

Disclaimer – This article is for general informational purposes only and does not constitute professional advice. Readers should seek professional guidance tailored to their specific circumstances before making financial or strategic decisions.

References (Endnotes)

- CB Insights, The Top Reasons Startups Fail, Research Brief

- Harvard Business Review, Why Startups Are Turning to Fractional CFOs

- PwC Insights, CFO Cost Structures and Alternatives

- U.S. Bank Study, Cash Flow Management and Business Failure Rates

- EY Startup Advisory, Investor Expectations and Financial Readiness